How much do coffee farmers make?

“Most coffee farmers live with less than $2 per day and grow coffee in areas below two hectares for a total production lesser than 6 bags, 360Kg kilograms of coffee per year.”

On August 22nd 2018, the coffee market price reached a record low of 95.45 cents/lb; the lowest it has been in almost 13 years. Although it has recovered since then, the event marked a new chapter on a nowadays permanent coffee crisis.

Likewise, the news triggered alarms among coffee farmers, especially to those, who remember the devastation caused by the coffee market breakdown in the early 2000s, when coffee prices fell below 42 cents/lb.

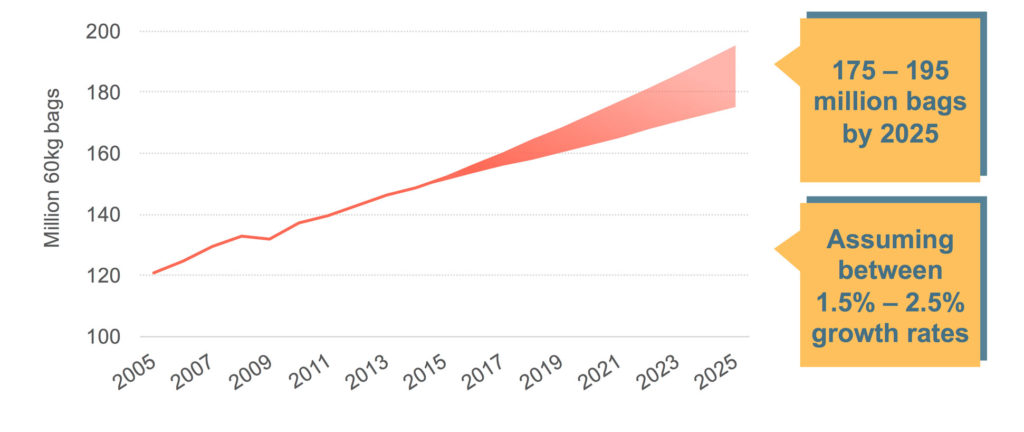

Falling coffee market tendencies, near collapse have become frequent and they won’t go away anytime soon; Brazil has double their coffee production in the past 25 years and Vietnam from a 0.1% of global share in the mid-70’s it is now the second largest coffee producer in the world, allocating 20% of the total market by 2017, and expecting to increase coffee production an astonishing 9% by the end of 2018 alone.

Despite increasing global demand; the growing coffee surplus injected into the global market each year, keeps exceeding coffee consumption leading to permanent low coffee market prices.

Why is there so much global coffee surplus?

For decades the only way coffee producing nations have found to guarantee revenue and offsetting the vicious effects of low market prices have been scaling production in a regular basis; Brazil and Vietnam have become very efficient at it; by dissolving production cost among larger volumes, allows them to keep production cost per pound relatively low and still profitable. Unfortunately this system seems to work just fine temporarily but it is unsustainable in the long run. A strategy that depends on systematically saturate the market, undoubtedly will deteriorate coffee prices; turning most coffee farmers and nations who could not meet same yields, unprofitable.

”Brazil and Vietnam must keep increasing coffee volumes each year in order to stay competitive. Despite Vietnam being second in terms of total coffee production. It is the leading country in competiveness for achieving the lowest coffee production cost in the world.”

In recent World Bank coffee production cost reports, only three coffee producing countries showed up to be profitable at current coffee market prices: Brazil, Vietnam and Indonesia. For the rest producing countries nonetheless, coffee farming is just a subsistence crop that doesn’t seem to be a sustainable activity after all.

A clear illustration of the lack of profitability at origin is represented by a significant drop in “Arabica Washed Coffee” volumes traded globally; from 44% global share in 1990, to 28% in 2010. If current trends persists, “Washed Arabica” would only constitute 21% of global market share by 2030.

While “Washed Coffees” or “Milds” are Specialty Coffee industry’s favorite and its consumption is thriven all over US and Europe; its production however, has halted and slowly decreasing, motivated particularly by the lack of investment and economic incentives; plus aging farmers and continuous defection of worker out of the coffee business.

SEE ALSO: What is the good, bad and ugly truth about washed coffee?

Would the coffee demand ever meet supply?

Emerging economies, more precisely China and India have become important coffee consumers in recent years. If their coffee habits keep growing, global coffee supply is expected to catch up with demand by 2020.

The opinions about the consequences of this are divided however, some people argue, higher demand would trigger higher market coffee prices, turning coffee farming into a more competitive and profitable activity. Some others nonetheless, pessimistically claim it would unleash a generalized global coffee crisis, once developed nation’s workforce is deprived from their favorite productivity fix. Nevertheless, similar situations have happened before, to coffee and other commodities as well, so it is not necessary to speculate.

Although coffee market price is the result of a meticulous balance between coffee’s supply and demand. It is well known in the field of basic economics that while demand is flexible, supply is inflexible.

What this mean is, while coffee consumers have the option to choose between tea, cocoa, guarana or any other caffeinated drink when coffee gets expensive and inaccessible; coffee producers however, have no other choice but to sale at a loss while coffee market prices get too low; by the time the harvesting season is over, most coffee farmers are experiencing, economically speaking, the leanest months of the year and have no bargaining power or time to spare.

Therefore, coffee farmers are very susceptible to abuse and rarely choose their customers or have any leverage on price or buying terms. At the end, most coffee farmers don’t sell to the highest bidder, but to whoever comes first, “first come first serve”.

Based on the above, I wouldn’t be too optimistic about demand catching up with supply in the next few years; personally I believe, demand would go down as supply declines, keeping coffee market prices not very different as they are today.

SEE ALSO: How can we help smallholder coffee farmers?

How could coffee farmers break the vicious circle?

In recent years the term, “Decommoditization” is getting more popular. It consists of adding value or differentiation to otherwise common products, commodities or services through value added or differentiation.

Certification:

One way widely used to decommoditize coffee has been through certification; consumers are willing to pay a little extra for coffee that has been produced in very specific ethical, social and environmental conditions based on strict rules stablished by the certification agencies. Nevertheless, as individual coffee farmer’s production volumes are low, smallholder farmers need to cooperate in certification as a group, which makes impact assessment more complicated. Many studies suggest that certification can have a small positive impact on participating households. But the added value of certification is substantially lower than the price premium, because of certification costs. Increasing both the membership of the producer groups and their deliveries of certified coffee are necessary to improve the rewards of certification.

If the whole purpose of coffee decommoditization is disregard the need of scaling up coffee production in order to make a profit. Certification still fails to deliver; the same as commodity coffee, it relies heavily on coffee volumes to be consider an effective alternative to fight low market prices.

Additionally, most coffee farmers around the world are not organized into groups or cooperatives. For these coffee farmers current certification schemes and benefits are not available.

Coffee Quality:

Specialty Coffee is a small fast-growing segment of the global market, it allows coffee farmers to add value by using their farming skills and terroir attributes to achieve unique coffee profiles and quality. It doesn’t necessarily rely on volumes to be profitable and it provides the highest revenues known to farmers. Unfortunately the segment is still too small to be consider a viable option for all coffee farmers to counteract low market prices.

Additionally, despite being a completely new product with huge value added, still traders, coffee buyers and exporters keep using the coffee commodity market price as a reference for valuing it; paying only small differentials above it as a premium to farmers.

No one in his right mind would ever use the price of commercial grape juice as a reference to buy a bottle of “Romanée Conti” wine; although both are technically grape juice, one of them have been transformed into a completely new product by a unique fermentation and aging process. Adding extra value over grape juice so significant that both could no longer be compared.

Likely, Specialty and commodity coffee are very different products, Nevertheless, due to the lack of leverage and bargaining power from farmers; still coffee pricing and assessment are traders, buyers and exporters responsibility. So they use the price reference that better suit them and it’s economically convenient for them as well.

Despite, Specialty Coffee prices offer the highest revenue and effective way to decommoditize coffee; still is heavily undervalue; sometimes even insufficient to cover the also higher production costs.

If it is so damaging. Why do we keep using the coffee market price as a reference to buy Specialty Coffee?

The answer is simple, it is good for business. As long as coffee traders, exporters and coffee buyers keep benefiting from the commodity market price as a reference to assess Specialty Coffee they will keep using it.

“The reason there will be no change is because the people who stand to lose from change have all the power. And the people who stand to gain from change have none of the power.”

Niccolò di Bernardo dei Machiavelli

Conclusions

- Despite, Specialty Coffee industry seems to be thriven all over Europe, USA and Asia. In reality, it is slowly dying; farmers can no longer bare the overwhelming costs and low profits. Many of them are quitting coffee farming and finding better options. We will see this trend to intensify as coffee market prices keep bottoming.

- “Decommoditization” is no longer an option for coffee farmers. It is essential in order to survive in current market circumstances. It is a difficult task many farmers would not be able to achieve. It is essential that coffee buyers, traders and exporters support farmers who are trying to differentiate by paying coffee prices that are also differentiated and disconnected from coffee market price.

- Certification schemes are a good idea but currently do not offer a viable option for poor and isolated coffee farmers to decommoditize coffee production. Innovation is necessary on this regard in order to make certification more affordable and reachable even for the most unprivileged coffee farmers.